Several home loan customers in Australia are robbing themselves of significant savings by not switching lenders. As both major and non-major banks flood the market with competitively priced home loan deals, borrowers with a set and forget attitude might find themselves paying thousands of dollars extra on their home loans, while their peers save money effortlessly by refinancing to better deals.

According to research, over one-third Australians are not aware of the interest rate on their home loan. If you happen to fall into this category, act now and review your home loan immediately. You might be surprised at the extra money you are throwing away each month, that could easily be used for paying off other debts, such as your credit card dues.

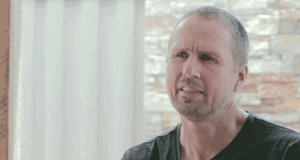

Simon Jeffrey, a Hashching customer, recently switched lenders, saving up to $5,000 per year. His new mortgage rate of 3.86 percent per annum is almost one percent lower than his original rate, bringing down his repayments to $490 from $800 a week.

"I had a home loan and a personal loan with the same institute. I basically wanted to merge the two lines to save some money, but they said no!" recounts Simon, who tried to reason again with his bank after six months, only to be turned away once again.

Fortunately, Simon came across Hashching while browsing the television one day. "What sold the idea on me was that they said they don't do dodgy brokers and all," says Simon. He is right; Hashching mortgage brokers must maintain a minimum user rating of 4.5 to continue receiving leads, which means stellar customer service for users. Simon contacted Hashching on Facebook and was put in touch with a [premium] mortgage broker, Darby.

"I contacted Simon and went through the motions with him to realise he was paying a higher interest rate than the average rate in the market. He also had two credit cards and a personal loan," recounts Darby, who helped Simon reduce one percent from his mortgage rate, saving him $5,000 in interest per year.

Apart from securing a competitive home loan deal for Simon, Darby also helped Simon manage his debts better. "I had two credit cards. Darby got them combined and put them through another institution that gave me 12 months interest-free," explains Simon. He is currently using the extra savings from refinancing to kill his credit card debt.