Will the HashChing lead management system (dashboard) work with my aggregator CRM?

HashChing’s dashboard captures the key milestones of a client file and works in parallel with aggregator CRMs. Our dashboard also provides brokers with access to digital tools such as document and bank statement requests, and centralised, exportable client contact solutions. Brokers will use their own CRM for compliance documents and online lodgement to the lender, but can easily export contact history and notes from HashChing to aggregator CRMs as needed.

Why do I need to have a photo on your website / why can I not use my business logo for the profile picture?

Your HashChing broker profile is used to build confidence and trust with our customers. This starts when customers review our services online, but most importantly, when they are introduced to their allocated broker.

Clients are instantly introduced to their assigned broker via email. The email showcases your broker image and business profile along with any ratings and reviews. A professional photo helps build trust and comfort with the services we provide.

What is the HashChing ‘Ask a Broker’ feature?

HashChing offers customers the option to ‘Ask a Broker’ on our website, allowing our brokers to respond to the queries of potential leads. Once a broker answers a question their information will be shown to the client, allowing them to select that broker for their enquiry if they are interested in doing so.

We encourage our broker partners to provide feedback and insight to customers where possible, but not to include any direct business information such as mobile numbers or emails in their response. Broker responses cannot be edited or deleted, so take the time to ensure you are happy with the feedback you are providing prior to submitting.

The customer can ‘close’ their question if they feel they have received a satisfactory response to their query. Once a customer ‘closes’ their question, broker partners will no longer be able to post a response to that query.

How do we manage a bad customer reviews on broker partner profiles?

HashChing encourages all customers to ‘rate the performance’ of their broker partner when their lead is closed, either successfully or unsuccessfully. The review is not related to the brokers' ability to source finance, but about their diligence, timeliness, and professionalism.

In circumstances where brokers receive a 3-star or lower review, the HashChing support team is immediately notified and the broker account is removed from receiving any additional leads until the review is further examined.

The support team will review the broker remarks added to the lead, as well as speak with the customer and broker to learn more. Reviews provided by customers are unable to be edited or deleted by broker partners.

Once the information is reviewed, HashChing can determine the best course of action, which may include removing the review. The Australian Competition and Consumer Commission (ACCC) provides clear guidelines on how to manage customer reviews and only in circumstances where the review is deemed punitive or incorrect will it be removed.

Once the investigation is completed, HashChing can re-activate the automatic assignment of leads to the reviewed broker partner. If you are a broker partner who believes there are grounds for a review to be removed, please contact the support team on support@hashching.com.au.

How does HashChing manage clawbacks?

If a loan settled via a HashChing broker partner is fully discharged within the first 24 months of the loan settlement, and the broker remains a HashChing partner broker at the time of the loan discharge, HashChing will reimburse 100% of the upfront invoice the broker paid to HashChing.

To claim this reimbursement you will need to contact the support team with the clawback notice and the original HashChing invoice.

Why don't I have access to all the rates listed on the HashChing website?

Our ‘rates’ page is a comprehensive list of broker introduced loans. The rates added by brokers depend on their aggregator and the aggregator lender panel. HashChing partners with brokers from all major aggregation models, which ensures a comprehensive rates page for consumers. Once brokers are approved as partner brokers, they are provided access to the HashChing dashboard where they can select the lenders and rates that they have access to.

The ‘rates’ on our website can be viewed and selected by customers. Once selected, these leads are circulated to brokers. Access to competitive rates is, therefore, a key driver of broker leads.

Any broker interested in rates they currently cannot access can speak with their aggregator BDM for further assistance.

Does HashChing have their own loan writing team?

HashChing does not employ brokers to work as loan writers or home loan consultants within the team. HashChing’s business model embraces the loan broker channel and all leads generated by HashChing’s online marketplace are automatically referred to as accredited HashChing broker partners.

The rates listed on the HashChing website - are they legitimate?

Yes. HashChing only partners with professional accredited mortgage brokers throughout all states and territories of Australia. Our ‘rates’ page showcases the broker introduced loans available across our network. HashChing only adds rates to the website after written confirmation of the product/rate by the broker partner or relevant lender.

Why has my new lead already been contacted by another HashChing broker partner?

HashChing assigns each lead to only one broker at a time, however, a lead may have used HashChing in the past, or may have submitted multiple inquiries.

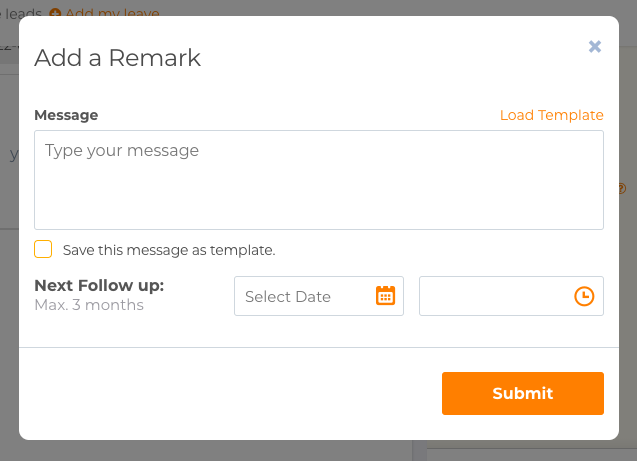

If you identify a lead that you believe is in touch with another HashChing broker you can add a remark and select the ‘HashChing Action’ checkbox to request our team to look into it.

Alternatively, please contact the HashChing support team by emailing support@hashching.com.au with details of the identified lead.

How do I send/resend the link to request a review from the customer?

Once a HashChing lead is closed, customers will automatically receive a digital notification prompting them to rate and review their experience with their assigned HashChing broker partner. Broker partners can resend this notification by selecting the appropriate lead from the ‘closed’ tab of the dashboard and clicking the orange ‘Send a Request’ button at the bottom of the page.

For broker added leads, the review request will always need to be sent manually.

Note that for broker own leads, reviews do not count toward your broker statistics (and becoming premium or gold) unless you opt-in. You can read more about this on the ‘Add a Lead’ page under ‘Manage Leads’ in the left sidebar of your dashboard.

How do I change my servicing area? Can I limit or expand my service area?

Yes. Brokers can log into their HashChing profile and change their servicing area (postcode) and radius to suit their needs. Broker partners have the ability to select a radius between 5kms – 75kms from the nominated postcode in which to receive leads. Brokers can also indicate that they are happy to service interstate leads, which will assign these types of leads in addition to the radius specified. Refer to the broker guide for a detailed step by step on how to do this.

Why am I receiving leads which are out of my service area?

Leads are circulated to HashChing partner brokers based on either the ‘rate’ and/or ‘postcode’ of a customer. For ‘rate’ based leads, HashChing will provide the lead to a ‘rate broker’ (a broker who has access to the rate client indicated interest in) within the postcode radius of the client. If there are no ‘rate brokers’ within the postcode radius, HashChing will assign the lead to a ‘rate broker’ within the state. In these circumstances, you may receive leads that fall outside the postcode radius you have selected. You can always contact the support team to reassign the lead if you are unable to service it for this reason.

Why am I being re-assigned existing/old leads?

HashChing offers brokers the flexibility of a month to month subscription. In circumstances where a HashChing broker partner chooses to cancel their subscription, their existing leads are promptly re-assigned to another HashChing broker partner, after we establish the ongoing interest and intention of the lead. The HashChing team will add a remark to the lead as part of the reassignment, which will be visible to the broker partner receiving the reassigned lead.